georgia film tax credits for sale

88 cents Per Dollar The taxpayer agrees to. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

Essential Guide Georgia Film Tax Credits Wrapbook

The state grants an additional 10 credit if the company uses the Made In Georgia logo in its film credits.

. The final tax credit sale to folks like you and me is usually at about a 10 discount so you would buy each 100 of Georgia tax credit for about 090. How-To Directions for Film Tax Credit Withholding. All production and post-production expenses must be in the state.

We broker the sale of state entertainment tax credits from film production studios to taxpayers so both buyer and seller leave satisfied. March 30 2022 559pm. You will receive a red errorwarning message about K-1s which you can ignore.

Paying less on Georgia income tax. The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute to its economy. To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later.

Recapture There are no recapture provisions for film credits. The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits. The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year.

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. The way it works is that production companies get a 20 credit on what they spend for certain expenses while making their project. Please note that discounts fluctuate.

If you make a movie and the whole. They get an additional 10 for providing that cool Georgia Peach logo at the end of the movieepisodeetc. An additional 10 percent uplift can be earned by including an embedded animated or static Georgia promotional logo provided by the Georgia Film Office.

Third Party Bulk Filers add Access to a Withholding Film Tax Account. The changes if signed into law would have capped the amount Georgia hands out in film and TV tax credits at 900. State of GA via Instagram.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Placed over 35 Million of Georgia Film Tax credits with buyers in 2015 Sold Millions of Illinois credits specializing in tax credits for television and commercial projects Multiple multi-Million Dollar sales in Louisiana including a 23 Million Dollar Louisiana Film Tax Credit sold for a major motion picture studio in 2015. The rewards are the tax credits.

Includes a promotional logo provided by the state. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. We offer film tax credits nationwide to ofset corporate individual tax liabilities for major studios and independent production companies.

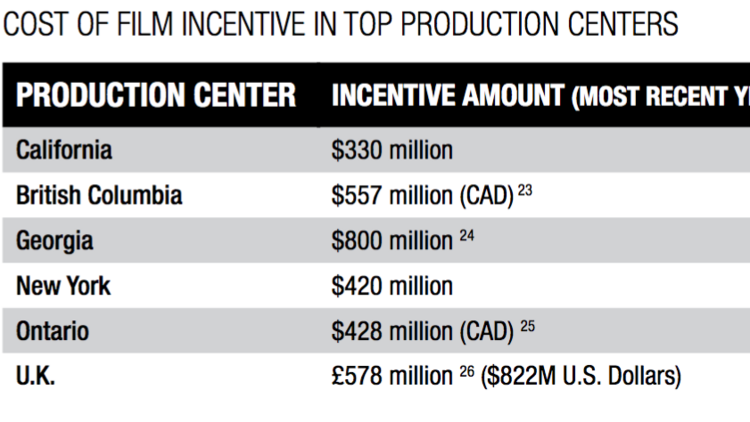

Louisiana paid out more than 200 million in transferable film tax credits in fiscal year 2012. How to File a Withholding Film Tax Return. The program is available to production companies that spend at least 500000 on production and post-production in Georgia either in a single production or on multiple projects.

Qualified projects distribution must extend outside the state of Georgia and have a minimum of 500000 qualified in-state expenditures over a. Unused credits carryover for five years. June 3 2019 1217 PM.

On August 4 2020 Governor Kemp signed into law HB. Register for a Withholding Film Tax Account. Production companies get a minimum of 20 tax credit.

On its own for example Missouris Historic Preservation Tax Credit which offers transferable tax breaks worth 25 percent of the cost to rehabilitate historic properties has cost the state 500 million over the last four years. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. Georgia Pulls Bill Proposing to Cap and Prohibit Sale of Film Tax Credits.

The new law appears to be in response to an audit report issued by the Department of Audits and Accounts DOAA earlier this year that called into question the. Claim Withholding reported on the G2-FP and the G2-FL. The 500 of withholding would be eligible for a refund.

Heres a Georgia film tax credit example. In order to take advantage of Georgias film tax credits most production companies transfer or sell them to other taxpayers. Getting a state tax deduction on Schedule A of your Form 1040 for the.

Taxpayer enters into a tax credit transfer agreement for 25000 of 2019 Georgia film tax credits from a Major Studio. Instructions for Production Companies. There are three main benefits for purchasing Georgia Entertainment Credits.

The-board flat tax credit of 20 percent to certified projects based on a minimum investment of 500000 over a single tax year on qualified expenditures in Georgia. All project types are eligible for Georgia film tax credit including game shows talk shows and reality TV. Tax The Georgia film credit can offset Georgia state income tax.

Most times these production companies cant use all of these credits and the Georgia Department of Revenue allows them to sell the credits. Credit Code 122 company name is the movie company no certificate 100 owner Federal EIN No and Credit Amount. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA.

Money to buy the credits. Georgia Scraps Bill To Cap Its 900 Million Film Incentives Barring Sale Of Tax Credits Update. In order to qualify individuals or corporations need to have.

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Sugar Creek Capital Film Entertainment Tax Credits

Essential Guide Georgia Film Tax Credits Wrapbook

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Film Tax Credits A Complete Guide Filmmaking Lifestyle

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Film Digital Media Tax Credits Clocktower Tax Credits Llc

Tax Incentives For Film Production We Ve Seen This Movie Before Wsj

Film And Tv S Tax Credits A State Guide To Competition The Hollywood Reporter

Essential Guide Georgia Film Tax Credits Wrapbook

Sugar Creek Capital Film Entertainment Tax Credits

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Film Industry Tax Incentives State By State 2022 Wrapbook

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety